- 0 replies

- 264 views

- Add Reply

- 0 replies

- 423 views

- Add Reply

- 0 replies

- 1,427 views

- Add Reply

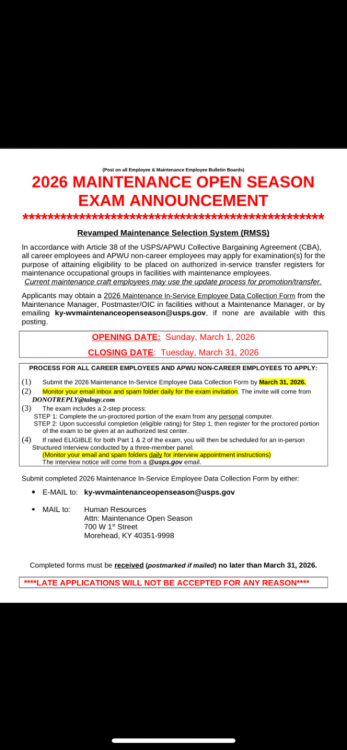

Maintenance Open Season

2026 Pay Period Calendar and Leave Chart Available

By Apwu133,

Clerk Division Settles Three Major Postal Support Employee National Disputes

By Apwu133,

November meeting notice

New health plan places for 2026

By Apwu133,